|

ASEAN Medical Devices &

Plastics Sectors : Immense Market Potential

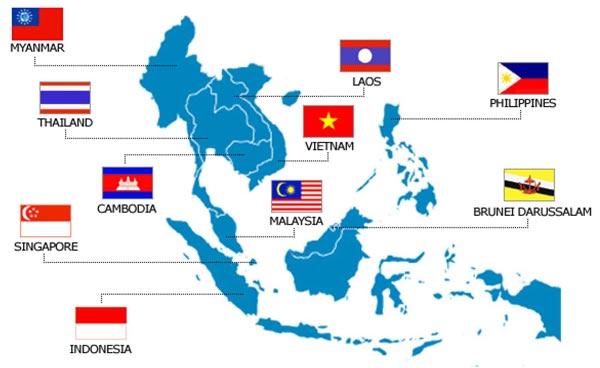

ASEAN (Association of Southeast Asian Nation). Economy

The ten member states making up ASEAN include Indonesia,

Malaysia, Philippines, Singapore, Thailand, Brunei,

Vietnam, Laos, Myanmar and Cambodia. ASEAN’s fertile

consumer base with a combined population of over 600

million and a combined GDP of US$ 2.6 trillion, as well as

presence in the global market, enables the region to tap

the right opportunities, hinging on the region’s rising

middle class sector and substantial consumer base. One of

ASEAN’s top export sectors by value is plastics and

plastic products earning US$ 39.3 billion in export

revenues in 2013, the International Trade Statistics

reported.

The sector’s production rates have witnessed a steady

average growth over the recent years, especially in the

ASEAN-6: Indonesia, Malaysia, the Philippines, Singapore,

Thailand, and Vietnam, which account for more than 95 % of

regional GDP, according to McKinsey & Company. Countries

like Cambodia and Myanmar are growing strongly, with

increased economic liberalisation and development, but

will still contribute only a small percentage of

manufacturing foreign direct investment (FDI) in the

coming years.

ASEAN’s Plastics Industry

ASEAN’s plastics industry is anticipated to expand in the

coming years.

In the ASEAN Business Outlook Survey , by the American

Chamber of Commerce Singapore and US Chamber of Commerce,

it was revealed that 19 % of ASEAN businesses themselves

plan to shift investment or business from China into their

own region. Respondents also identified Indonesia as the

most attractive country for new business expansion,

followed by Vietnam, Thailand, and Myanmar. The

availability of low-cost labour in countries such as

Cambodia, Indonesia, Laos, Myanmar, and Vietnam could be a

competitive advantage.

With the growth of ASEAN countries’ consumer bases,

broadening of plastic import and export markets, and

expanding foreign trading powers, ASEAN’s plastics

industry offers significant opportunities.

ASEAN Medical Devices Industry : Immense Market Potential

Medical manufacturing is one of the key growth areas in

countries belonging to the Association of Southeast Asian

Nations (ASEAN). A rapidly expanding middle class is

largely responsible for a projected near doubling of the

medical device market in these countries, from $4.6

billion in 2013 to $9 billion by 2019.

Three ASEAN countries - Malaysia, Indonesia, and Thailand

- account for approximately 65% of the current medical

device market among the 10 member countries, according to

Matthew Zito, Benedict Lynn, and Emily Liu of business

intelligence firm Dezan Shira & Associates. The other

seven are Singapore, the Phillipines, Brunei, Vietnam,

Laos, Myanmar, and Cambodia.

Medical device markets within the region have been

charting double digit growth rates in recent years, and

will likely continue to do so. “With the increased demand

for better healthcare, encouraged by governmental focus on

healthcare as a priority sector for trade and service

liberalization . . . the upside market potential for

medical devices in the region is immense,”.

The individual medical device markets across ASEAN’s 10

member countries are in various stages of development.

Those with the greatest presence in the medtech market can

be broken down as follows:

-

Malaysia and Indonesia, which are rich in rubber, lead

global production in latex products such as surgical

gloves and syringes. Malaysian exports in diagnostic

imaging have expanded in recent years, according to

research by Espicom, which estimates the country is likely

to see compound annual growth of 16.1% to 2018, with

growth for consumables as high as 24.8%.

-

Singapore, the region’s medical and technological hub, has

a thriving biomedical research and development industry,

and a competitive advantage in advanced

manufacturing. It is home to the manufacturing operations

of more than 30 medical technology firms.

-

Thailand also has a relatively robust medical device

market, worth approximately $1 billion and growing 15%

annually, according to Ames Gross, President of Pacific

Bridge Medical (Bethesda, MD).

On the regulatory front, ASEAN member countries have made

significant strides toward developing a mature regulatory

framework for medical devices, both individually and

regionally.

ASEAN countries currently remain reliant on imports to

satisfy demand for medical devices: for example, as much

as 97% of devices consumed in Indonesia in 2013 were

imported, mainly from the United States, Japan, and

Europe. Nevertheless, momentum is building for local

manufacturing to transition toward more advanced products,

as foreign companies move into the region to take

advantage of lower costs and rising demand.

South East Asian Pharma Industry

The South East Asian pharma industry has been growing at

an average of 6-10 percent in the past 10 years. The

governments across the ASEAN region are introducing

universal healthcare programmes, with the consequential

rising demand for all categories of medicines, especially

generic drugs.

Comprising almost 40 per cent of the SEA economic output,

Indonesia is now the largest pharma market in the

Southeast Asia/Asia Pacific region (SEA/AP), experiencing

an impressive 85 per cent growth in between 2007-2013. The

country has the biggest and fastest growing economy in the

SEA region and a pharma economy consisting of

approximately 200 pharmaceutical companies.

There are already 25-30 generic domestic companies with

access to the international market and equally, there are

approximately 35 multinational companies, such as Sanofi,

ACG and Novo Nordisk, established in the area. Most

significantly however, are the remaining domestic

manufacturers, who are increasingly targeting

international sales in neighbouring countries.

|

Sept. 20 – 23, 2017 |

T-PLAS 2017 - A Global Platform with an ASEAN Perspective

on the Buoyant Opportunities in the region.

Bringing together industry leaders from the best local and

international brand names from the plastic and rubber

sectors, T-PLAS 2017 to be held in Bangkok offers a full

spectrum of specialised equipment, high-precision

machinery, semifinished products, raw materials,

applications and solutions serving the plastic and rubber

value chain. Gain special insights on growing markets such

as manufacturing of plastics for the medical, packaging,

and automotive sectors.

A synergistic platform with Focused Medical & Healthcare

Plastic Pavilion

- Global Innovations , Strategic Presence

A dedicated “Medical & Healthcare Plastic Pavilion” is

conceptualized by “T-PLAS 2017 “ in association with

“MEDICAL PLASTICS DATA SERVICE” which will be participated

by Exporters and Manufacturers of Materials, Machinery and

Products to the Medical Plastics, Medical Devices and

Pharmaceuticals Industries. |

The Pavilion will showcase latest developments by regional

and international exporters And manufacturers Of Medical

Plastics Processing Machinery, Pharmaceuticals / Medical

Products Packaging Machinery, Medical Polymers, Components

/ Tubings /Adhessives, Packaging Films / Pouches etc.

Driven by the nation’s various burgeoning sectors such as

Medical, Pharmaceuticals, Packaging as well as Lifestyle,

Thailand is well positioned to become Southeast Asia’s

very own hub for its plastics and rubber industries. These

areas of interests have seen significant growth in recent

years, and are projected to expand to be heights in years

to come. |