|

Trends

In Medical Device Distribution In India

Mr. Sanjay Jha

Director, ColMed |

India is currently the 4th largest

medical devices market in Asia after Japan, China and

South Korea and the medical devices market in the

country is expected to grow to USD 50 billion by 2025.

With a rapidly expanding healthcare

sector, India is today a lucrative market for all

global companies manufacturing and selling medical

devices and equipment. Most global companies are

already selling products in India or are planning to

enter the market. Even as the diversity and complexity

of the Indian market remains a challenge for

distributors, a series of new developments and trends

are laying ground for improved regulatory standards,

cost effective interventions as well as

improved supply chain management.

Prominent new trends that are

expected to impact the medical devices distribution in

recent years are : |

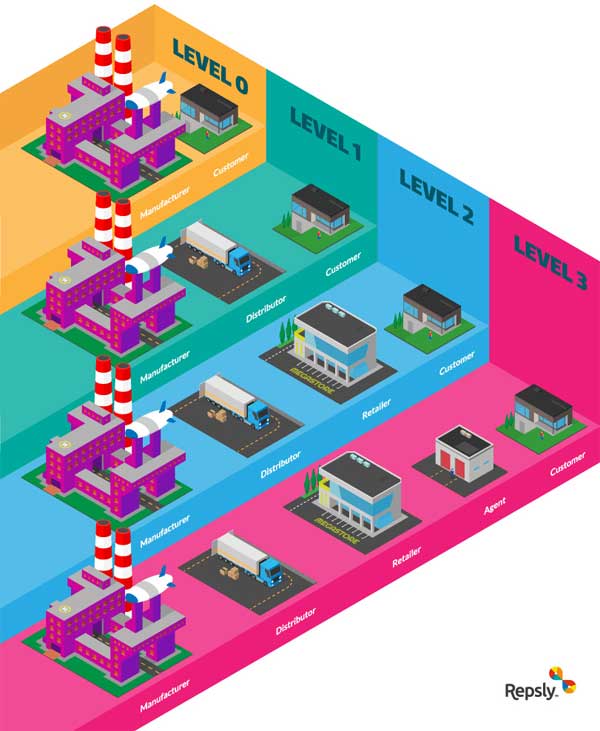

1. Distribution

Rationalization:

For OEMs, managing

distribution networks and sales channels effectively has

always been a significant area of concern. Today, many

OEM's have devised a strategy in which they focus on their

core job of developing products, leaving the distribution

conundrum to specialist group purchasing organizations. As

seen in the USA, the complete Distribution model is

outsourced to a few National Distributors, commonly

referred to as Group Purchasing Organizations (GPO), who

through their expertise and established tiers of

distribution, make available the medical products to

Healthcare Professionals. ColMed is one such Indian

company, which has been at the forefront of this

revolution in India. The GPO's big-dollar investment in

quality manpower and sophisticated inventory control

systems, help local distributors in Tier 2 & Tier 3 cities

in catering to health centers, by enabling them to procure

quality products at affordable price.

It is a win-win model

for all, since OEM's can focus on enhancing Product

Aware-ness, GPOs can use their expertise of distribution,

Tier 2 & Tier 3 distributors can purchase products at low

price in spite of limited buying volumes, and customers

get access to a wide array of products at reason able

price.

2. Pricing

Regulations by Government and its implication on

Distribution

Recognizing the need to

improve regulatory standards for medical devices, the

government has initiated measures to set up a separate

regulatory authority for this sector that hitherto came

under the domain of drug regulator Central Drugs Control

Standard Organization. The government is planning to set

up a Medical Devices Authority (MDA) that will devise

Indian regulatory norms for the entire spectrum in the

medical devices sector that till now adheres to FDA

regulations. The government is also working on rules for

rationalizing the trade margins for medical devices that

have been categorized as drugs. In fact, price caps have

already been introduced on devices such as stents,

reducing the profit margins of hospitals as well as

distributors.

All these measures are set to make

regulations more stringent for devices, even as price

regulations will have an impact on trade margins.

Distributors are now trying to work on finding innovative

distribution strategies that are more cost effective.

3. Reducing Quality Differentiation:

A number of factors have helped bridge

the brand differentiation between the products of MNCs and

local manufacturers. These factors include improvement in

quality of Indian manufacturing and wide scale

acceptability of Indian manufacturer products which offer

good results at lower costs. The wide brand choices have

reduced brand differentiation, which has helped local OEMs

to compete with International MNCs. Though manufacturing

remains limited to producing low technology products, a

few domestic companies and MNCs with manufacturing

facilities in India have successfully developed low cost

products that are on par in terms of quality with existing

products that require complex technical know-how to

manufacture. These products have succeeded in developing a

niche market in many regions globally. For example, Indian

manufactured heart valves have found new export markets in

Myanmar, Kenya and Thailand. This has helped the medical

devices exports register strong growth.

4. Improved supply chain management

using Artificial Intelligence & Machine learning

Supply chain management is often highly

under-rated part of an efficient distribution network. A

report by an American healthcare supply chain management

company concluded that improving supply chain management

can enable health systems to reduce their supply expenses

by an average of 17.7%, equivalent to USD 11 million

annually per hospital.

Growing realization about the need to

institute efficacious supply chain management practices

have led distributors to turn to sophisticated

technologies like artificial intelligence (AI) and machine

learning that can leverage big data and help standardize

processes. This in turn results in better predictability,

optimization of supplies and reduction of wastage and

expenses. AI based algorithms that use vast data for

predictive analysis proves to be particularly useful in

supply chain applications. Similarly, a McKinsey

study found that using AI to enhance supply chain

management could cut forecasting errors by 20% to 50%.

As Medical Device & Consumable

distribution moves towards optimization of resources, AI

based applications are set to become a norm in supply

chain management practices.

5. Greater consolidation of

businesses and growing role of private

equity players

A rapidly growing healthcare

distribution business is fast catching the attention of

private equity players who have turned towards investing

in medical distribution

businesses. This will result in greater standardization of

practices and inflow of more expertise in the sector.

Apart from entrance of more private equity players, a

greater consolidation of businesses also seems to be on

the cards. Globally, pharmaceutical and devices

distribution have consolidated to a large extent. However,

in India it is still largely fragmented. A series of

acquisitions and mergers are already underway in the

sector and the trend is likely to continue. As we move

towards greater consolidation, this will also result in

better supply chain management practices and improved

technological prowess.

|

Collateral Medical (Colmed is the

abbreviation) is India's leading medical device,

instruments, consumables & disposables marketing and

distribution company in India. Our customers include

medical professionals, purchase managers; and endusers

such as patients, expecting mothers, etc. We serve our

customers through direct mail. We have 100+ industry-specialised

support staff, field sales representatives, backed

with sophisticated organized order processing

enterprise resource planning software to streamline

procurement, ordering, invoicing, dispatch &

accounting.

We support medical professionals by

providing products and services in an efficient and

transparent way. Our customers are connected, informed

and are known to adapt to using technology to their

advantage.

We are committed to providing the

industry with high-quality medical devices at the

lowest possible prices. We believe that this will not

only improve the quality of healthcare access, but

will also increase healthcare access.

Our industry-specialised, highly

trained support staff and field sales representatives

are proof of our customer-centric philosophy. We keep

abreast of industry competition and trends within our

core markets, and our customers have come to rely on

our ability to adapt to changing markets and the

industry's evolving needs.

We work as a team, sharing ideas

and conventions, to deliver the best possible outcomes

to our customers. We ensure integrity by delivering on

our promises and making things happen.

Our teamís desire is to make

significant contributions to the communities in which

we work. We have a restless desire to take things to

the next level, to stretch our abilities and become

the number one full-service provider to independent

hospitals and doctors who operate under controlled

budgets.

Our robust partnerships with

various national & international OEMs like 3M, J&J,

Roche, BPL, Cochlear give us an edge over our

competition. We always strive for symbiotic

association with various Brands. There are many

success stories of exclusive OEM tie ups which has led

to various Medical Devices & Consumable companies in

reaching length and breadth of India, using our

professional service & robust distribution partners

pan India.

(Based on views shared by Mr Sanjay Jha, Director ,

ColMed as pushed on the following web link :

https://www.biospectrumindia.com/views/70/15585/trends-inmedical-devices-distribution-2019-and-beyond-.html) |

|