|

Go to Market Strategies

for Medical Device Start-ups and Entrepreneurs in India

Bhupesh Sood

CEO, SEC Global Consulting |

Tapan Kumar Patel

Principal Consultant, SEC Global Consulting |

Overview

India is the 4th largest market for medical devices in

Asia. Medical device sector is projected to register a

CAGR of 14.8% and is expected to reach $11.86 bn in

2021-22.

As stated by the new market research report on medical

device outsourcing, the United States represents the

largest market worldwide. Asia-Pacific is forecast to

record the fastest CAGR of 14.9% over the analysis

period- 2020. Less expensive production of devices

coupled with adherence to stringent international

quality standards marks the emergence of Asia as the

most desirable production hub. Asian countries,

specifically India and China, are emerging as attractive

low-cost destinations for leading medical devices OEMs.

India’s medical devices industry is poised for

significant growth in the next five years: The market

size is expected to reach $50 bn by 2025. 100% FDI is

allowed under the automatic route for both brownfield

and greenfield setups. Strong FDI inflows reflect the

confidence of global players in the Indian market.

Since April

2000, $2.1 bn in FDI. Of this, $600 mn was

received in the last 5 years. Singapore, United States,

Europe, and Japan are key investors.

Equipment & Instruments, Consumables and Implants have

attracted most FDI . The Government of India has taken

several steps to ensure the growth of a vibrant

ecosystem of medical devices manufacturing in India over

the past 5 years:

-

Recognized Medical Devices as a sunrise sector under

Make in India campaign, 2014

-

The Medical Devices Rule of 2017

-

Adopted risk-based classification based on GHT

guidelines: Classes A, B, C, D

-

Perpetual licences for manufacturers

-

The Medical Devices Amendment Rules of 2020 bring all

medical devices in India under regulation as drugs. The

medical devices industry in India consists of large

multinationals as well as small and medium

enterprises (SMEs) growing at an unprecedented scale.

-

The current market size of the medical devices industry

in India is estimated to be $11 bn.

Around 65% of the manufacturers in India are mostly

domestic players operating in the consumables segment

and catering to local consumption with limited exports.

Large Multinational Corporations lead the high

technology end of the Medical Devices market with

extensive service networks. There are 750–800 domestic

Medical Devices manufacturers in India. The

manufacturing is developing in its scale and geography:

there are six Medical devices manufacturing “clusters”

in the country. Clusters have “Medical Device Parks”

developing around them: states have committed to set-up

dedicated industrial parks where efficient domestic

manufacturing at lower costs. In 2019, Andhra Pradesh,

Telangana, Tamil Nadu, and Kerala have got in

principal approval from Government of India for

new medical devices parks.

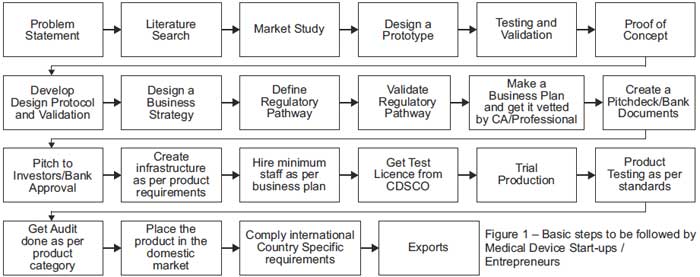

The Process from Ideation to Customer (i.e. Patient)

|

Understanding the applicable standards

When any Medical Device Start-ups /

Entrepreneurs is considering to venture into the medical

device manufacturing he has to consider many factors

before the product is placed in the market. He has to

work a lot on the compliance requirements that are

applicable to the product, that is proposed to be placed

on the Indian market. Many such manufacturers will fail

if they are not keeping an eye on the product related

compliance requirements.

Example 1 – Infusion Set – If you

plan to make an infusion set, say Sterile Single Use

Scalp Vein (Winged Needle) Infusion Set, then BIS

requirements that need to be followed are IS 16097:2013.

In addition to these, you also need to understand the

sterilisation requirements along with testing and

laboratory requirements.

Example 2 – Blood Transfusion Set

- Similarly, say Blood Transfusion Set (for Single Use

Only), the requirements shall be ISO 8536-4 compliant

spike, ISO 594/1 & ISO 594/2 compliant end connection.

In addition to these, you also need to understand the

sterilisation requirements. along with testing and

laboratory requirements. |

|

|

Advertisers'

Index

|

|

Accuprec Research Labs Pvt. Ltd., India |

|

Ambica Medicare Engineering, India |

|

Nu-Vu Conair Pvt. Ltd., India |

|

Celanese Corporation, India |

|

CLS Pvt.

Ltd., India |

|

Carclo Technical Plastics Pvt. Ltd.,

India |

|

Covstro India |

|

ET Elastomer Technik, Germany |

|

Eewa Engineering Co. Pvt. Ltd., India |

|

Ineos Styrolution India Ltd., India |

|

I-Kare Polyalloys Pvt. Ltd., India |

|

KLJ

Group, India |

|

Lubrizol Advanced Materials India Pvt.

Ltd. |

|

Lyondellbasell, India |

|

Mediscient Devices (OPC) Pvt. Ltd., India |

|

Milliken & Company, India |

|

Maider Medical Industry Equipment Ltd.China |

|

Mega Compound Co. Ltd., China |

|

Milacron India Pvt. Ltd., India |

|

GLR Laboratories

Pvt. Ltd., India |

|

HighRichja Precision Extrusion Machinery Co. Ltd., China |

|

PVC Colouring Compounding & Processing,

India |

|

Qosina,

USA |

|

Raumedic AG |

|

San

Printech Pvt. Ltd., India |

|

Schottli, Switzerland |

|

SMC Medical Manufacturing Pvt. Ltd.,

India |

|

Steri Techno Fab, India |

|

Tekni-Plex India Pvt. Ltd., India |

|

Twist Engineering Works,India |

|

Airways Surgical Pvt. Ltd., India |

|

Alpha Medicare and Devices Ltd., India |

|

Alpha Therapeutics Pvt. Ltd., India |

|

Angiplast Pvt. Ltd., India |

|

Beacon Plastics, India |

|

Delux Surgical, Inida |

|

Jain Rubbers Pvt. Ltd., India |

|

New

Vimko Plastics, India |

|

Operon Strategist, India |

|

R.R. Patel Gases (P) Ltd., India |

|

SEC Global Consulting & Initiative LLP,

India |

|

Surgi Pack India Pvt. Ltd. |

|

Vinit Performance Polymers Pvt. Ltd., India |

|

Amigo Surgi Care

Pvt. Ltd., India |

|

Apex Medical Devices, India |

|

Jimit Medico Surgicals Pvt. Ltd. |

|

Life-O-Line Technologist, India |

|

Mesco Surgical, India |

|

Morrisons

Lifecare Pvt. Ltd., India |

|

National Healthcare, India |

|

Pharmadocx, Inida |

|

S. Nath & Co., India |

|

Unikal Consultants, India |

|