|

NMDPC : To Catalyse

Growth of Medical Device Sector in India

|

Dr. Jitendar Sharma

Member Secretary, National Medical Devices Promotion

Council and MD & CEO AMTZ |

An Introduction to NMDPC: The

National Medical Devices Promotion Council (NMDPC) has

been set up as a catalyst-organization for facilitating

and promoting the Indian Medical Device Industry, under

the aegis of Department for Promotion of Industry and

Internal Trade (DPIIT) on 7th December 2018, with Andhra

Pradesh MedTech Zone (AMTZ) as its

technical secretariat. On 14th of December 2018, the then

Hon’ble Minister of Commerce & Industry inaugurates NMDPC

at the “4th WHO Global Forum on Medical Devices”, held at

the AMTZ Campus, Visakhapatnam, Andhra Pradesh.

NMDPC with its core objective to

promote and facilitate the Medical Device Industry and

create a nurturing ecosystem (which the sector lacked), is

poised to be the National Forum now to discuss and consult

stake holders of the Medical Device ecosystem (ranging

from policy makers, start-ups, incubators, R&D

institutions-to-manufacturers of vivid size and

capabilities) and partner with organizations of

international repute, who can add value and prescribe

solutions pertaining to growth of medical

device manufacturing and exports.

As the apex Council for facilitating

and promoting the Medical Device industry and to position

India as a pioneer in Medical Device and Health technology

space, following are some key activities undertaken by the

council:

• Policy Facilitation

• Strategic Forums (Policy, Best Practices, Partnerships)

• Dissemination of International Norms

• Industry Support (Manufacturing, Regulatory Challenges,

etc.)

• Market Access

Boosting Indigenous

Manufacturing-Enabling Level Playing Opportunities to

Harness True Potential: Since inception, the council

has been interacting closely with the stake holders from

government, as well as private sectors (manufacturer/

supplier), healthcare providers and patient groups. It was

found that initiatives that are directed towards

benefitting the medical device manufacturers with respect

to Preference to Make in India, Order 2017 or through the

implementation provisions from Department of Pharma were

in a way not followed in heart and spirit and doesn’t

reflect in the tenders floated by many State & Central

Government Agencies. Additionally, the Make-in-India

proposition may also take a back seat if timely payments

are not released to the manufacturers or suppliers whose

payments are pending for year/s together from the State/

Central Health Corporations. Though the manufacturers are

integral part of the value chain, however such

discouraging instances may lead to a severe cash crunch to

them or land them in bankruptcy or put a threat to their

existence or sustainability of their existing projects,

performing R&D, finding markets, commissioning newer

initiatives, all of them can take hit for the same reason.

Tender Deviations:

NMDPC has reviewed more than 200 odd tenders across the

country from the period April 2019 to July 2019, and have

found 38% of them deviating in terms of mandating foreign

regulations or some of them are even upright asking

specific company for supplying or mentioning their brand

name, thus killing fair competition and are once again not

adhering with General Financial Rules, 2017 (GFR)

guidelines. Such tenders are possibly biased, and are

against the larger interest of the manufacturing

community, especially narrowing the scope of Indian

manufacturers to participate in the state/ central led

procurement process.

Table1: Total number of

Tenders studied from April to July 2019

| No. |

Period |

Deviations |

Without Deviations |

Total Tenders |

| 1 |

1 - 30 April 2019 |

8 |

15 |

23 |

| 2 |

1 - 15 May 2019 |

8 |

16 |

24 |

| 3 |

16 - 31 May 2019 |

16 |

41 |

57 |

| 4 |

1 - 15 June 2019 |

11 |

13 |

24 |

| 5 |

16 - 30 June 2019 |

11 |

20 |

31 |

| 6 |

1 - 15 July 2019 |

8 |

15 |

23 |

| 7 |

16 – 31 July 2019 |

18 |

12 |

30 |

| |

Total |

80 |

132 |

212 |

| |

Total Percentage of

Deviations |

38% |

| |

Total Percentage without

Deviations |

62% |

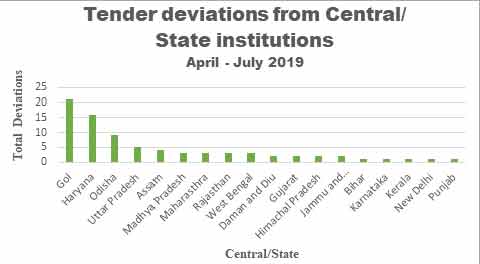

From Table 1, the

percentage of tender deviation is approximately 38%

accounting to 80 tenders which are asking exclusively for

foreign regulatory approvals in India. Of these deviations

the GoI or Central government organizations have shown

overall 26% deviation while Haryana state government alone

has shown about 20% deviation as shown in graph 1 below.

Graph 1: Tender

Deviations amongst State and Central organizations

Considering the high

value and importance of medical device equipments in the

field of Radiology and Cardiology, NMDPC has further

assessed deviation of tenders into three categories,

namely – 1. Radiology, 2. Cardiology, and 3. Others. It is

found that of the total deviations 36% of tender

deviations fall under Radiology and Cardiology categories.

Way Forward:

Transparent procurement practices with adherence to Public

Procurement Order 2017 can open a lot of avenues for

Indian manufacturers, provided payments are also settled

with the manufactures in a timebound manner. Secondly,

National Medical Devices Promotion Council realizes that

there is a distinct ecosystem advantage which can be

provided to the medical device stakeholders while

operating out of a cluster, considering Andhra Pradesh

MedTech Zone (AMTZ) as a model cluster where common

resources like infrastructure, scientific facility,

testing facility, sterilization facility, regulatory

enablement and market access are in complete synchrony

with manufacturing. Replicating such clusters and linking

them with each other or linking them to the existing

clusters for enabling smooth flow of services can go a

long way as far as import substitution is concerned, and

thus making the best use of the capabilities which already

exists..

|